Actively engaged

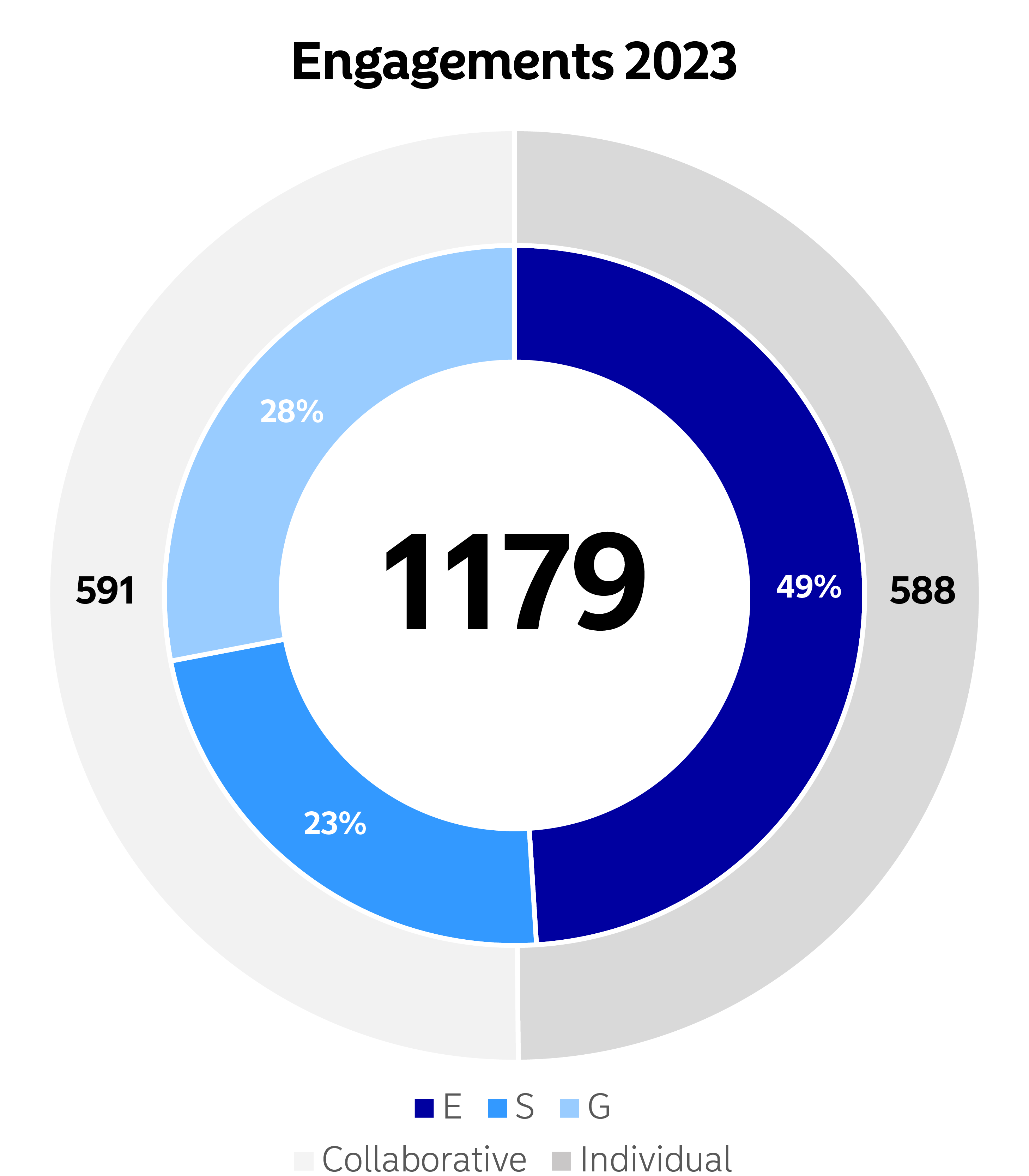

To support our mission to deliver returns and responsibility, we engage with companies to help them enhance and maintain their ESG activities.

Creating positive change

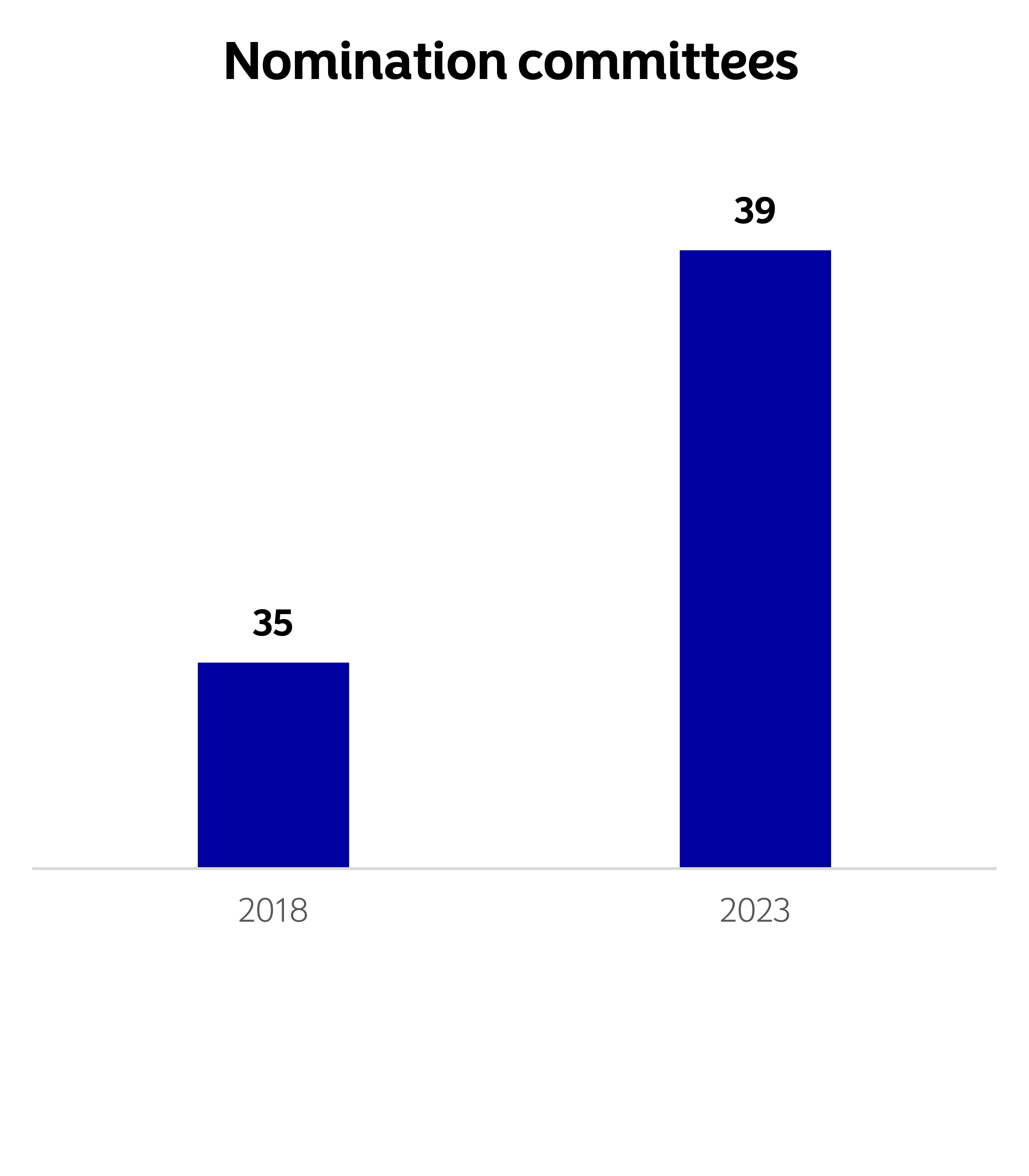

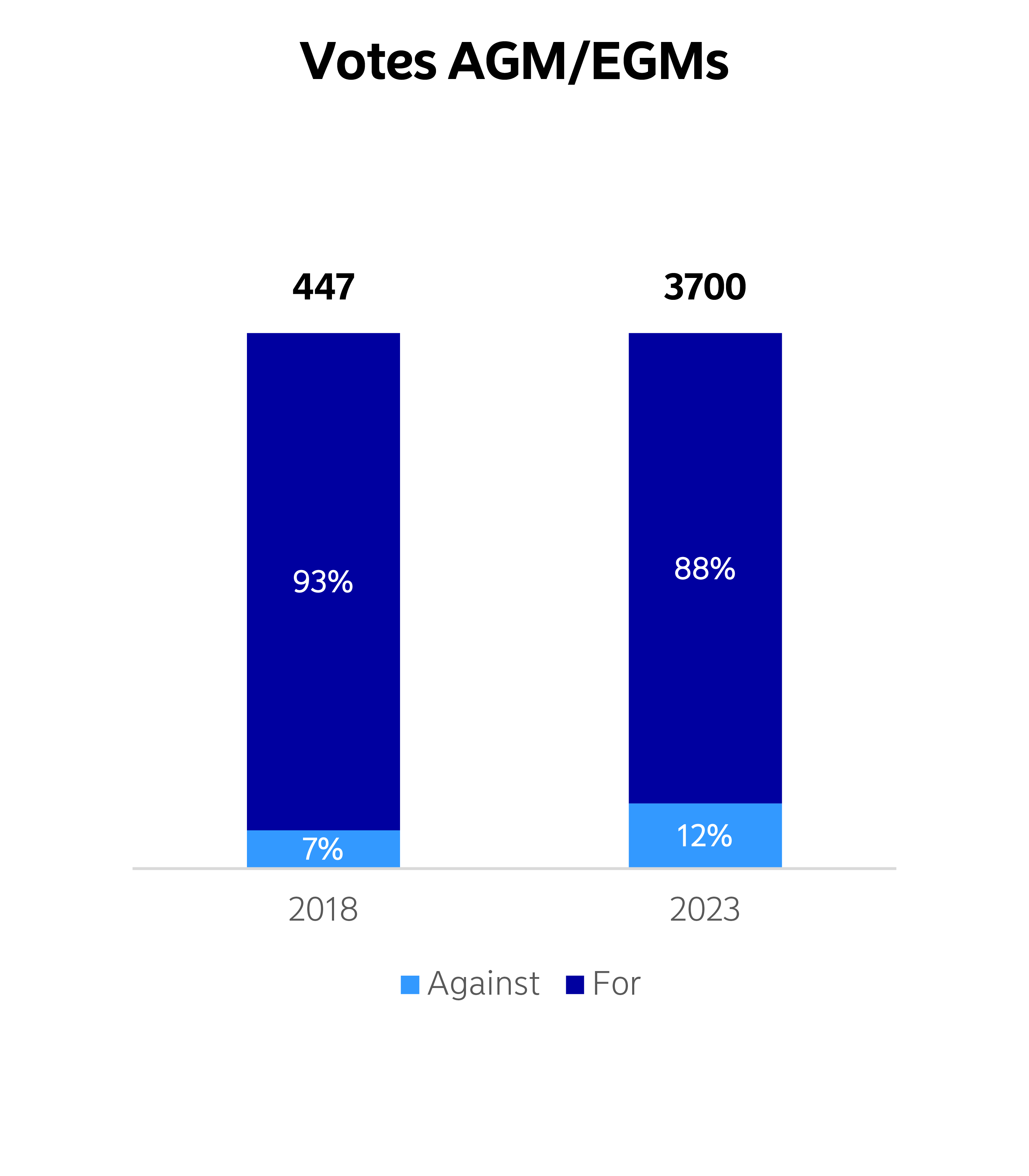

Active ownership is a powerful way to protect shareholder value, enhance long-term returns and foster positive change. We do this by exercising our formal voting rights as well as proactively engaging with companies and encouraging them to improve their management systems and ESG performance.

Source: Nordea Asset Management Responsible Investments Report 2023

Methane Engagement Case

Engaging with Pharma Industry

Methane Collaborative Engagement

Methane Engagement Case

Engaging with companies in the oil and gas industry on the disclosure and mitigation of their methane emissions.

- Methane is a powerful greenhouse gas, estimated to account for as much as 25%* of the global warming we’re experiencing today

- Our primary engagement ask is for investee companies with methane emissions to join the OGMP 2.0 framework

- At the end of 2023, engaged with 63 companies on the topic. As a result, nine companies in the engagement joined the OGMP 2.0

- Our Methane Campaign extends to industry best practice initiatives: we participated to the Canada Methane Mitigation summit in September 2023

- Learn more about “Pollution reduction initiative of the year” from Sustainable Company Awards 2023

*Source: International Energy Agency

2024 PRI Award Winner

Methane Engagement Campaign

In October 2024, NAM won the “Recognition for Action – Climate” award at the Principles for Responsible Investment (PRI) Awards ceremony in Toronto, Canada.

NAM has been recognized for its leadership in spearheading a collaborative engagement of approximately 20 investors focused on enhancing disclosures and reducing company methane emissions to near zero within the energy, utilities and waste management sectors.

Engaging with Pharma Industry

Danger in the water

Engaging with pharmaceutical companies to address the role they play in India’s water pollution crisis.

Key points:

- The death toll related to antimicrobial resistance (AMR) is estimated to reach 10 million people annually by the year 2050*

- Pharma pollution in India has been identified as a major contributor to the problem

- NAM initiated a long-term engagement with pharma companies based in India that we are invested in

- We issued two reports exposing the extent of pharma pollution in India

- As a result of our engagement, the PSCI developed an action plan to address the problem

*Source: UN Environment Programme